Combine & Conquer In The Agentic AI Space - Part IV: The Disruption Scorecard for Indian Agentic AI Startups

Series Recap

In Part I of this series, we saw a new reality emerge as AI giants moved up the stack to enter the agent space. In Part II, the "vibe coding" category served as a stark warning for how quickly a valuable agentic market can be absorbed by the underlying LLM providers. In Part III, we built a practical framework to measure the defensibility of agentic AI startups.-

Now in Part IV, we apply that framework to a select group of 21 Indian Agentic AI companies to identify and segregate the more vulnerable and the less. While we have 50+ Agentic AI companies in the companies directory, we chose to go with ranking just these 21 companies as these are the more prominent ones in terms of higher amounts of funds raised, revenues, etc. than the rest of the pool.

Let's dive in to see the results that our framework came up with -

The Danger Zone

Of these 21 prominent Agentic AI startups that we evaluated, we found that 5 of them are quite quite quite vulnerable to competition and disruption from the frontline LLM providers. Talk about the speed and direction of disruption! For a sector that came into its own barely 5 years ago, seeing intra sector disruption and incumbents driving the disruption of the new entrants, is quite the surprise!

| Company | Rationale |

|---|---|

| Adopt.ai | Provides a platform for creating a Tier I in-app, natural language command interface. This is a feature, not a complete business solution. As host applications develop their own embedded agentic capabilities, the need for an external tool like Adopt.ai will likely diminish. |

| Beacon.li | Offers a no-code Tier I "AI Product Assistant" to be embedded in other software for user onboarding. This is a high-risk category because the function is not mission-critical and is increasingly being built as a native feature by software companies themselves, reducing the need for a third-party solution. |

| Ema | Positions itself as a horizontal "Universal AI Employee" platform. Although its orchestration engine is powerful, its pre-built personas are Tier I assistants for generic functions (sales, HR), placing it in direct competition with the increasingly capable agent builders from the "OS" providers. Its breadth is its biggest vulnerability. |

| Lyzr.ai | A no-code/low-code platform for building simple Tier I agents and scripted workflows. Its pre-built templates are on the thin wrapper side, offering functionality that is rapidly becoming a native feature of the major LLM platforms, making it highly vulnerable. |

| Zams | Its primary go-to-market product is a tool-stack & data integrations platform that is now under threat from similar platforms from the frontline LLM providers. Their case studies indicate custom ML done for their clients, but its success will depend on the platform's continued success. |

Now these 5 companies did not start with a poor business model or product portfolio, they built simple agents or agent builder platforms around LLMs, which made them early entrants into this Agentic AI space. But the flip side to being early was that now as these frontline LLM providers bring to market the same kinds of agentic capabilities, it definitely queers the pitch of these companies to their clients.

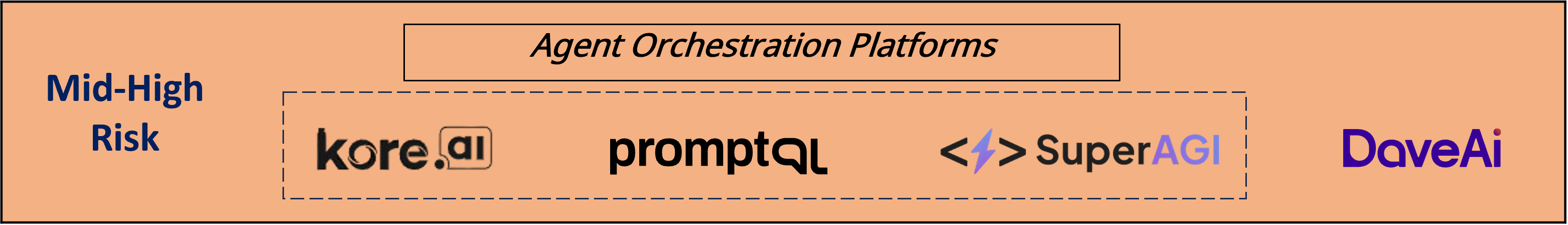

Platform Encroachment: When Giants Move Into Your Turf

| Company | Rationale |

|---|---|

| Kore.ai | An established enterprise conversational AI platform with deep integrations. However, its core offering of over 400 pre-built agents is primarily Tier I (rule-based tasks, FAQs). This once-strong moat is shrinking as LLM-native platforms begin to offer more advanced, generative agent orchestration, putting Kore.ai's legacy business model under pressure. |

| SuperAGI | A focused Tier II agent platform for SMB sales and marketing workflows. While its focus is a strength, its target market (SMBs) and low-ACV pricing model lead to low switching costs. This, combined with its narrow functional niche, makes it vulnerable to being outflanked by larger platforms entering the sales automation space. |

| Hasura/Promptly | A no-code platform for building Tier I and Tier II agents. Its key differentiator is its "knowledge and behavior layer," which aims to improve the accuracy of agents querying organizational data. This is a temporary moat, as the major LLM providers are heavily investing in and rapidly improving this exact capability. |

| DaveAI | Vertically-focused company whose Tier II 3D AI Virtual Avatars for sales tasks provides it a temporary moat, but the rapid advancement of multimodal agents from Google and OpenAI (voice + vision + action) will intensify competition in this space significantly. |

Again bear in mind, these companies developed libraries of agent templates, integrations, knowledge graphs and general orchestration, etc. at a time when the LLM providers were just that - LLM providers. But as these LLM providers are scaling up their enterprise plays, they are building out these very same capabilities. So, why have another vendor for something the LLM providers are already addressing?

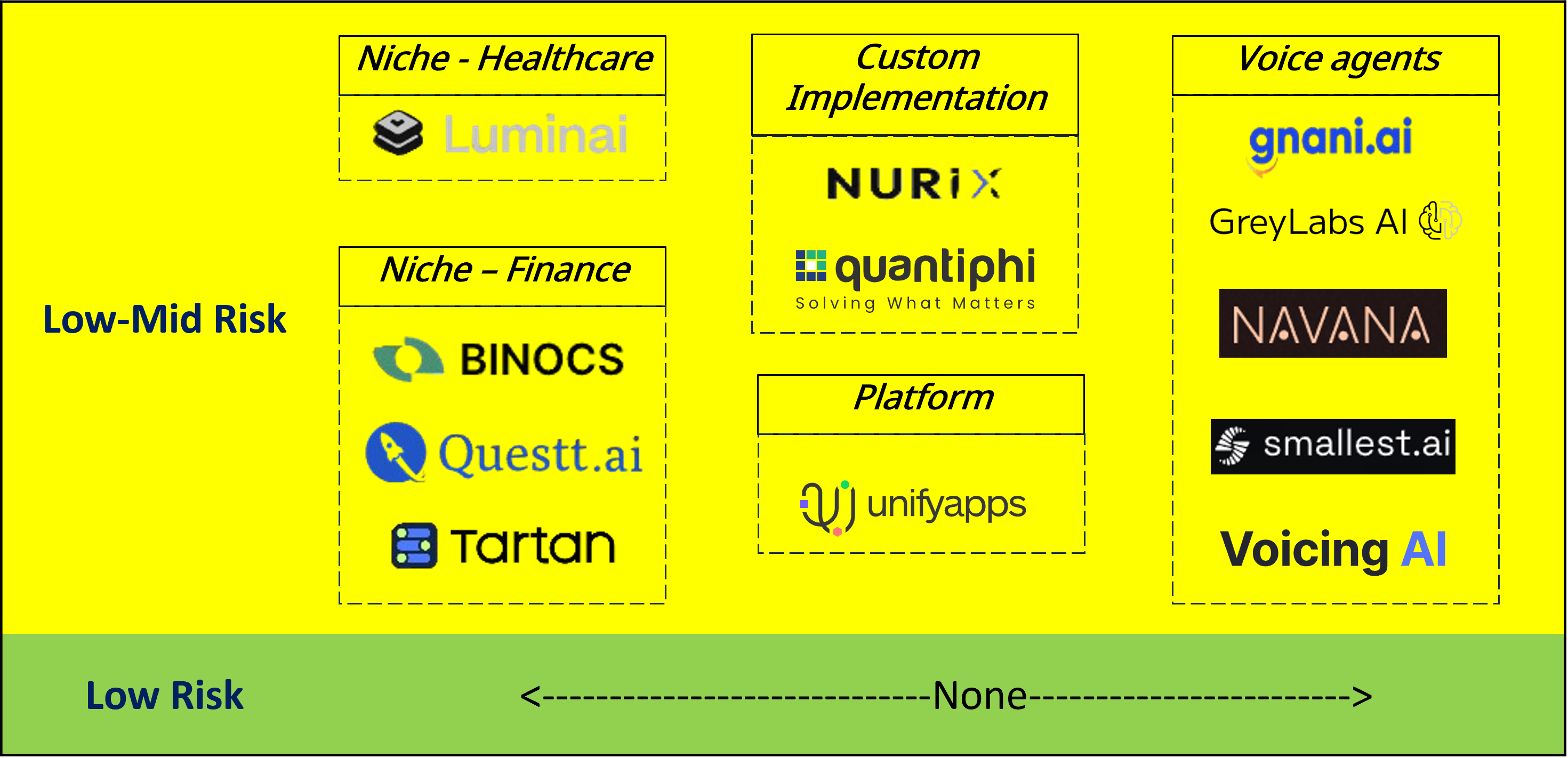

The Safe-For-Now Zone

The eleven companies in this more resilient cluster have built defensible moats. They have avoided the Commodity Zone by focusing on Tier II Tactical** and Tier III Strategic agents and workflows in specific verticals. Their value is not just the AI but the codified business logic and deep integrations that are difficult for a generic platform to replicate.

| Company | Rationale |

|---|---|

| Luminai | A bespoke service model focused on deep, complex Tier II/Tier III workflows in the highly-regulated healthcare vertical, reducing risk of easy rip-and-replace. |

| Binocs | A pure vertical application for the high-stakes financial due diligence market, representing a defensible Tier II/Tier III niche. |

| Questt | A full-stack Tier II/Tier III "AI CFO" platform with a deep focus on finance workflows and compliance, creating a strong vertical moat. |

| TartanHQ | A layered stack combining a data infrastructure moat with Tier II agentic apps for regulated financial services workflows. |

| Nurix | A bespoke service model focused on building Tier II agents for select verticals like insurance, avoiding direct platform competition. |

| Quantiphi | A consulting led implementation model whose custom, complex Tier II/Tier III delivery work for large enterprises is less vulnerable to commoditization. |

| UnifyApps | A full-stack, no-code platform aimed at large enterprises. While it faces competition from the LLM providers, its much wider data integrations (1,000+ connectors) and enterprise-grade governance, gives it a stronger defensibility story than lighter, more horizontal platforms. |

| Gnani.ai | Protected by a three-part moat: voice-first orchestration, deep BFSI process knowledge, and Indic language specialization. |

| Greylabs.ai | Highly defensible due to a hyper-specialized focus: Tier II voice agents for the BFSI vertical in the Indian market. |

| Smallest.ai | A niche voice AI player whose defensibility comes from a combination of vertical specialization (e.g., Tier II agents for debt collection) and geographic focus (India). This creates market fragmentation that the larger players may be slow to address. |

| Voicing.ai | Has a defensible niche in voice-first Tier II agents. Their focus on the voice channel and their claim of proprietary, industry-specific LLMs for verticals like healthcare and banking provide a stronger moat than generic, text-only agent builders. |

How are these companies different from the vulnerable ones?

Being vertical or niche players is essentially the defining characteristic of these companies. Unlike the vulnerable ones, who are more horizontal and focused on light capabilities can be quickly brought to market. Of course, niche players have their own challenges around scalability and TAM size, but being able to implement their solutions without the constant threat of disruption from the LLM providers (who are deep pocketed, have massive distribution and very very innovative) might just let them thrive long enough to build up market share in their niches and then maybe explore additional categories or niches.

Concluding Thoughts & Next Steps

The pattern is undeniable: companies that are horizontal, focused on generic Tier I (Operational) agents and workflows are in a precarious position. Those that are vertical, own complex Tier II (Tactical) or Tier III (Strategic) workflows, and have a high-value enterprise business model are relatively safer. Like we said earlier, the companies in the "Danger Zone" didn't necessarily make poor choices. In many ways, they are the pioneers, building simple agents and platforms when that was the cutting edge. But in a sector moving at lightning speed, the ground is shifting beneath them. And bear in mind, we have merely considered the competitive pressure from the frontline LLM providers here, when rating these 21 Agentic AI companies. There is also the competitive pressure from other Agentic AI companies in India and abroad, where relevant. Not to speak of the broader SaaS space where, traditional software and SaaS companies are making their own moves in AI and agents.

For startups navigating this new terrain, the only durable advantage is to be a specialist. But being in a niche is not a one-time decision, instead, there has to be a continuous process of seeking out complexity, and additional specializations & niches, to stay ahead of the zone of disruption.

So, what does this market bifurcation mean for the future? It sets the stage for a wave of strategic moves. While the most vulnerable companies face a difficult path, the more resilient players in the "Safe-For-Now Zone" become interesting assets. Stay tuned.

Related Reading

A practical framework to measure how defensible an Agentic AI startup really is against disruption from OpenAI, Google and Anthropic — and why not all agent companies are built to survive.

Combine & Conquer In The Agentic AI Space - Part III - Measuring Disruption and Resilience →