RBI To Permit Indian Banks To Finance M&A - How Big Of A Deal Might This Be?

RBI's Landmark Decision: Unpacking the Policy Shift

The Reserve Bank of India (RBI) on 1 Oct, proposed to provide an enabling framework for Indian banks to finance acquisitions by Indian corporates. Until now, Indian banks were not allowed to finance domestic M&A, which left the field open for NBFCs, private credit funds and debt markets to step in with debt financing for such transactions. Indian banks were also constrained in financing cross border M&A. They were shut out of financing inbound M&A, leaving the market open for foreign credit investors. For outbound M&A, Indian banks could lend, but only from their offshore branches.

These restrictions on M&A financing have been in place for at least the last 35 years, so this change in RBI's stance is quite momentous. And RBI did not do away with the restrictions unilaterally. Indian banks, led by the largest lender - SBI, have been reaching out to the RBI seeking this policy change, as they clearly saw that Indian companies were in need of M&A financing. But while regulations held back Indian banks from catering to this demand, foreign banks & investors could participate in such financing from offshore. In short, there was a two pronged issue for Indian banks -

a. restriction on catering to an existing demand, even for domestic M&A and

b. foreign entities financing cross border M&A

Addressing Market Gaps and Global Parity

So this change in RBI's stance will finally put Indian banks on same footing as existing incumbents in both domestic M&A and outbound M&A financing. For banks this is a new area to lend to and for the RBI, this dovetails into their other initiatives around internationalizing the INR and addressing geopolitical challenges with increased & diversified cross border commerce. There are parallels here - China tried this outbound M&A playbook in the 2000-2020 period with great success. And speaking of China, in Aug 2025, the PBoC proposed increasing bank financing of M&A to up to 80% of deal value & up to 10 years of duration, up from 60% & 7 years in 2015 and from 50% & 5 years in 2008. All the more reason for RBI to make this policy shift now.

Following the RBI's announcement, there is upbeat commentary about the unlocking of a major lending opportunity for Indian banks -

A report by SBI said that in 2024, M&A financing....translates into a potential annual credit growth of Rs 1.2 lakh crore

However, it is also important to look at the global corporate debt markets to know what might lie ahead for Indian banks.

Trends In Global M&A Financing Landscape

Let's start with the USA, what are the main trends there?

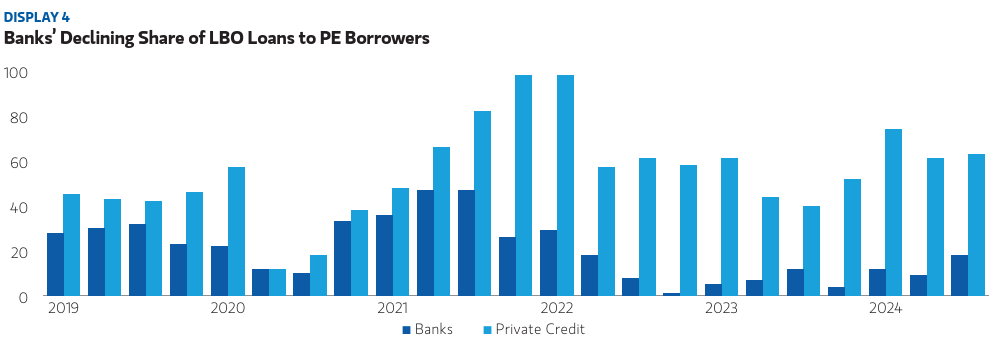

In the US, where leveraged finance markets are among the most evolved globally, the story over the past five years has been one of steady displacement of banks by private credit in funding buyouts and M&A - aka the Golden Age of Private Credit. Data from Morgan Stanley shows that since 2019, private credit providers have taken a dominant share of LBO lending, accounting for roughly two-thirds to ~90% of yearly volumes. Financing from private credit also seems a lot more resilient to macros including covid shutdowns of 2020 and the interest rate hikes of 2022-23, which bank financing is a lot more influenced by as seen in its ebbs and flows.

Source - Morgan Stanley

But volumes say half of the story, but do indicate that private credit does dominate the mid market. Banks on the other hand play a decisive role in large-cap transactions, where scale and pricing efficiency matter. This Bloomberg article from Oct 2024, mentions that several marquee buyouts saw a return of bank-led underwriting

Investment banks, forced to take big writedowns on risky merger and acquisitions loans after a global surge in interest rates, are now jumping back into leveraged buyouts — one of the most lucrative areas in finance. So far, about $2.4 trillion worth of mergers and acquisitions have been announced this year, up 22% from the same period in 2023, according to data compiled by Bloomberg.

Investment bankers are touting all-in packages of senior loans, bonds and junior debt for deals....and can provide leverage levels of 7.0x and in excess of that, something that wouldn’t have been conceivable 12-18 months ago. That puts them back at levels that were common before the hung debt saga.

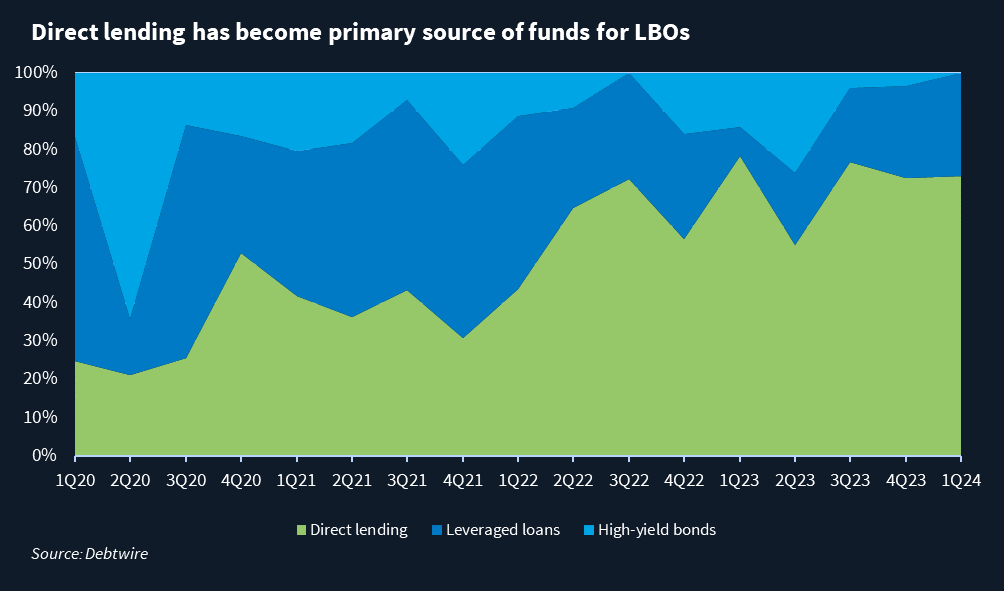

Now while LBOs and M&A are not the same thing, but there is overlap and we can infer that even in M&A, private credit dominates the mid-market, while banks and capital markets anchor the largest deals, but are quite susceptible to macro shifts. And private credit has exploited these cyclical retreats by banks to entrench themselves into M&A financing.

What about Europe?

Again a similar story - private credit (i.e. direct lending) again stealing the march over the traditional bank financing and bonds.

Source - ION Analytics

And what do incumbents in Indian market say of this policy change?

The general sentiment from private credit players is that they are unlikely to be impacted by the entry of Indian banks into M&A financing. Of course, such opinions can be biased, but their rationale is based on that M&A financing accounts for ~15-25% of demand for private credit in India and that private credit players are nimble and ready to offer bespoke products unlike banks who are likely to move slower and stick to traditional instruments (partly due to regulations). And on top, banks are likely to limit themselves to asset heavy and large deals in the near term, leaving the rest of the market relatively unimpacted.

Coming to India, how deep are our M&A markets?

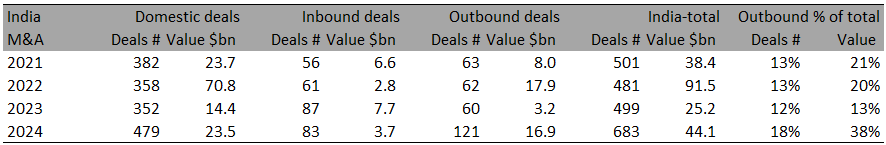

Indian outbound M&A is not all that big yet and foreign banks are entrenched into that space.

Source - Grant Thornton

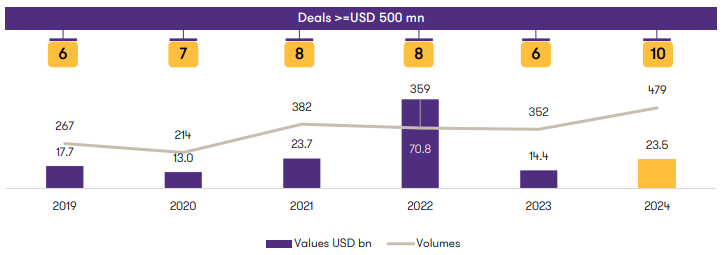

And if Indian banks are to target large ticket domestic M&A for financing, there again is a similar paucity in deal volumes. We are barely getting 10 domestic deals of sizes >$500mn per year currently and growth in those volumes will take time-

Source - Grant Thornton

So, what should Indian banks do?

They can try to compete in the niches - outbound M&A or large ticket domestic M&A. But those have entrenched players already be it foreign banks or mutual funds and NBFCs. And settle for whatever lending volumes they can get.

Or....

They can not limit themselves by the larger ticket sizes or real assets and actually look to cater to good quality domestic and outbound M&A. But that still leaves the question of nimbleness.

And this is where banks and everybody in M&A need to understand nimbleness better. Nimbleness is understood mainly as how quickly a financier or an investor can complete their deal evaluation and provide the financing. While banks and regulated lenders may have longer deal evaluation workflows, as opposed to say private credit, they can address the nimbleness by starting their evaluation sooner than other financiers. And no, this early evaluation does not have to be extensive or wasteful.

In the GenAI age, it is eminently feasible to identify good M&A ideas across sectors, situations and sizes and then start the evaluation and target engagement to drive them towards M&A. In doing so, not only will the banks have much better odds in landing the financing mandates, but also be able to do it from a position of deep understanding of acquirer and target, courtesy the work put in during early evaluation and engagement.

And are there any M&A partners who can readily help Indian banks with good M&A ideas?

Deals! Deals! Deals!

The Deals section of The India Portfolio is alive! Sign up now and see for yourself.

Find Your Next Deal →