Want to know what is going on in the world of AI & ML investments in India?

What subsegments exist within the broader AI & ML space? When did these subsegments start to emerge?

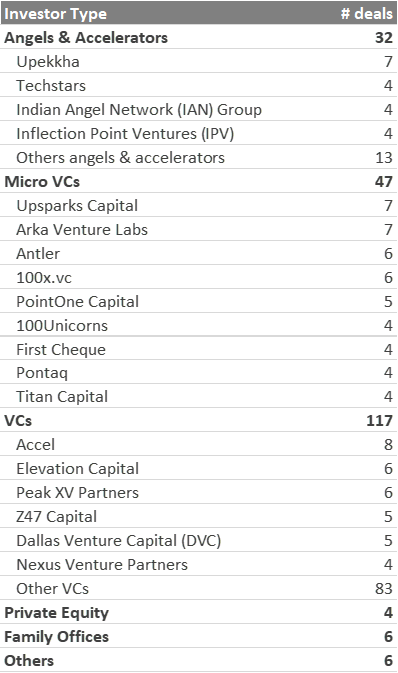

Who are the most active VC/PE investors?

Here are the answers to these questions:

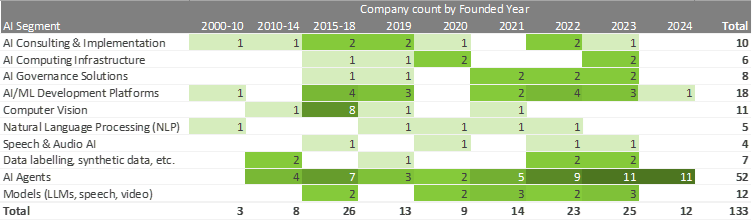

The India Portfolio in its directory has 133 AI & ML companies, backed by 95 VC/PE investors, across 212 deals. This heat map below breaks up these 133 VC/PE-backed companies by subsegments and the year these companies were founded.

Predictably, new company creation picked up sharply in 2022-23, just as generative AI became a global phenomenon. AI Agents is now the most prominent subsegment, accounting for ~40% of companies in the sector. However, it is also heartening to see thriving niches like AI Governance Solutions, Data Labeling, Computing Infra, and even AI Models (mainly video models)—this particular cluster is especially important for the emergence of state-of-the-art models out of India.

Computer vision is another interesting niche addressing real-world problems ranging from surveillance, object identification, defect detection, etc. And then there are the AI Consulting companies—these are some of the oldest and highest-funded businesses (owing to their vintage). Interestingly, several companies in this segment have pivoted to productized offerings, including Agents.

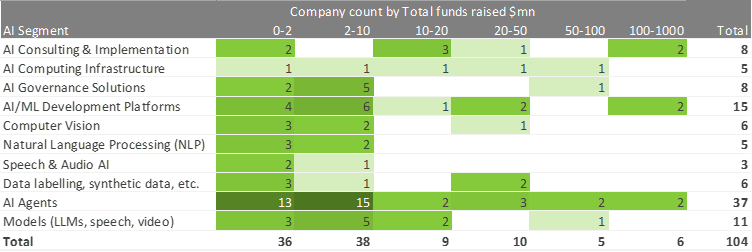

Speaking of financing, this next heatmap slots these AI & ML companies into buckets based on their total funds raised to date. Note that of the 133 companies in the directory, we could find public data on fund raises for only 104 of them.

The nascency of the space is further reinforced by this heatmap—70% of the companies have raised up to $10 million so far. Note the frenzy within the Agents space: 28 companies have raised up to $10 million, and another 15 companies (52 minus 37) in the Agents space whose fundraising history is not available.

You know what that means?

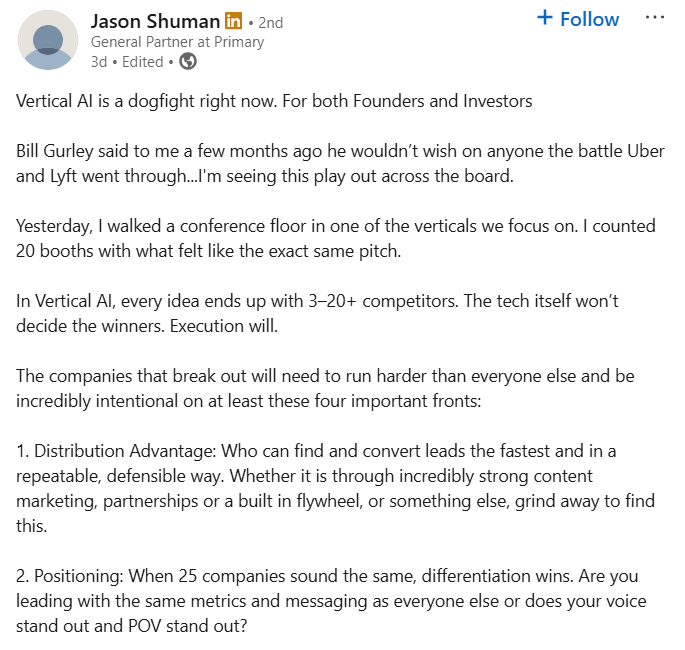

If you are a founder or investor within this AI Agents space, start M&A. That will give you the escape velocity to zoom past competition and get into the upper reaches of customer lists, contract sizes, and capital. Speed is important here, as you want to be doing your M&A before the rest of your founder and investor peers start voicing thoughts like Jason:

Granted, he mentions vertical AI, but look up what that is and discover it is all agentic workflows and augmented retrievals and observability and such. However, where I will disagree with Jason is that the four differentiators he mentions (distribution, positioning, pricing, onboarding speed), in my opinion, do not predictably identify winners. Not when there are many companies in a sector, backed by many investors, and the sector itself is seeing rapid changes and trend shifts.

From the launch of ChatGPT in November 2022 to the Nano Banana and Veo 3 infused Gemini now. From context lengths of 64k tokens and RAGs to dump-your-whole-folders-into 1 million tokens now. From the arms race around parameters and model sizes to distilled models and reinforcement learnings and small specialized models. From basic chatbots to agentic workflows and MCPs. All of these products and methodologies are the outcomes of the cutting edge being done at breakneck speed by great teams and companies—execution is not a constraint here.

Fighting brutal fights to differentiate is not the wise or the only choice that incumbents have; they can combine and redirect their resources to better pursuits while their newfound scale holds off competitors. Investors ought to pay attention to which companies choose to move fast on M&A; the odds of finding winners are probably much better there.

Speaking of investors, want to know who the most active investors in the AI & ML space are? Here they are:

Building The India Portfolio #2 – Now Search Funds & Companies by Sectors

Building The India Portfolio #2 – Now Search Funds & Companies by Sectors

Read full story →