Building The India Portfolio #1 – A Simple Scale For VC Strategies & Rounds

On the island of Sulawesi, live the tribe of Doges. Their motto -

And on Bintan, live the Cheems, their sacred rules being -

"In private equity, everything is growth, even what isn't" - Buyside Monke, probably

"We are raising our pre-seed tranche #2 v2025 fully convertible note, with the valuation linked to the price of the Series F round (discounted 3x, adjusted for price movement of avocado 2030 futures)" - average early stage round now

Before Uber turned into a decacorn, these two worlds- VC & PE lived on their own separate islands, focused, flourishing & unbothered about how they defined their rounds and such. But private-for-longer holding periods + lower-for-longer rates + benign macros of 2010-2015 meant that VCs were happy to hold on to assets for longer than before (than push companies to go public) and that meant a creep in the alphabet table of round names and soon Series G, H, V, Z came into being. Their growth cousins, meanwhile saw the clear shift that tech was causing to consumer behaviour and decided they could no longer stay away from the tech bandwagon and what began first as late stage tech funds, became a stampede into the full spectrum of the VC deals and further splintering of simple rounds into tranches and bridges and follow ons and avocado futures linked pricing. (Technically, the Tiger from Sumatra & fellow market liquidity providers played their part in initiating the trend, but it took the growth Doges to turn it into a stampede).

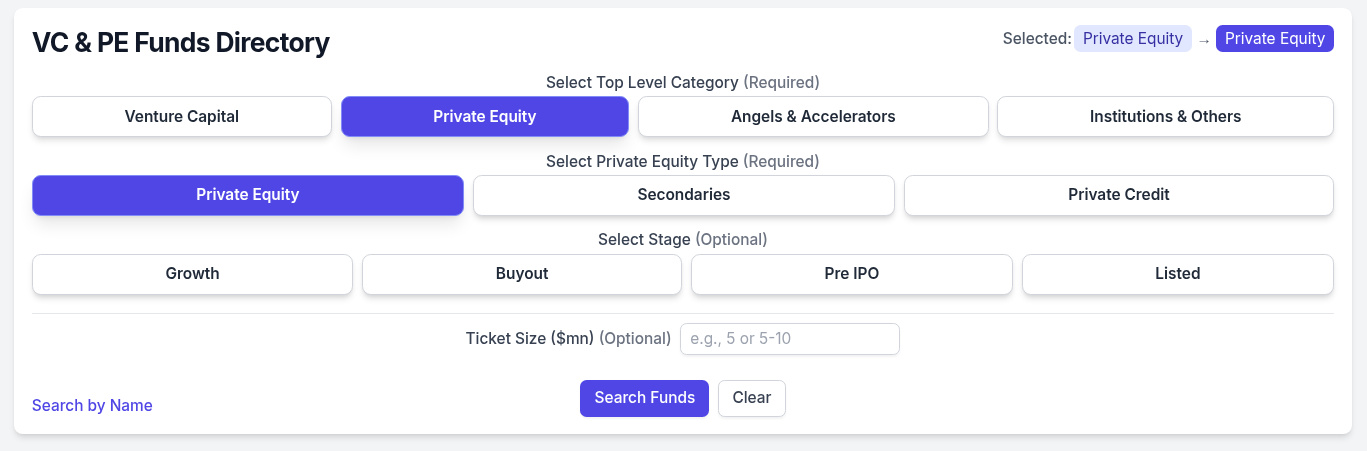

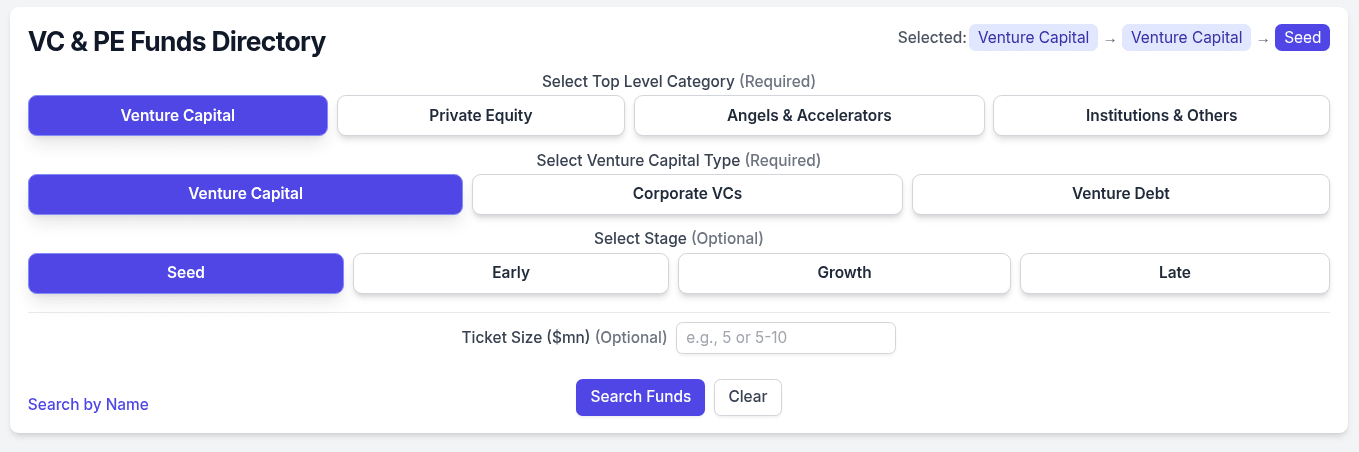

And here we are in present day, where even rounds before seed have several distinct types - initial, family & friends, pre-seed and so on. And bringing sanity & brevity to the early stage one of the first challenges that came up when trying to create the directory of VC & PE funds and other institutional investors within The India Portfolio. Given, just how simple the private equity strategy spectrum is, something similar was needed for the VC side.

And thus, the simplified and unified VC strategy spectrum was formed.

Anything seed or earlier is just seed, with no further fragmentation below it.

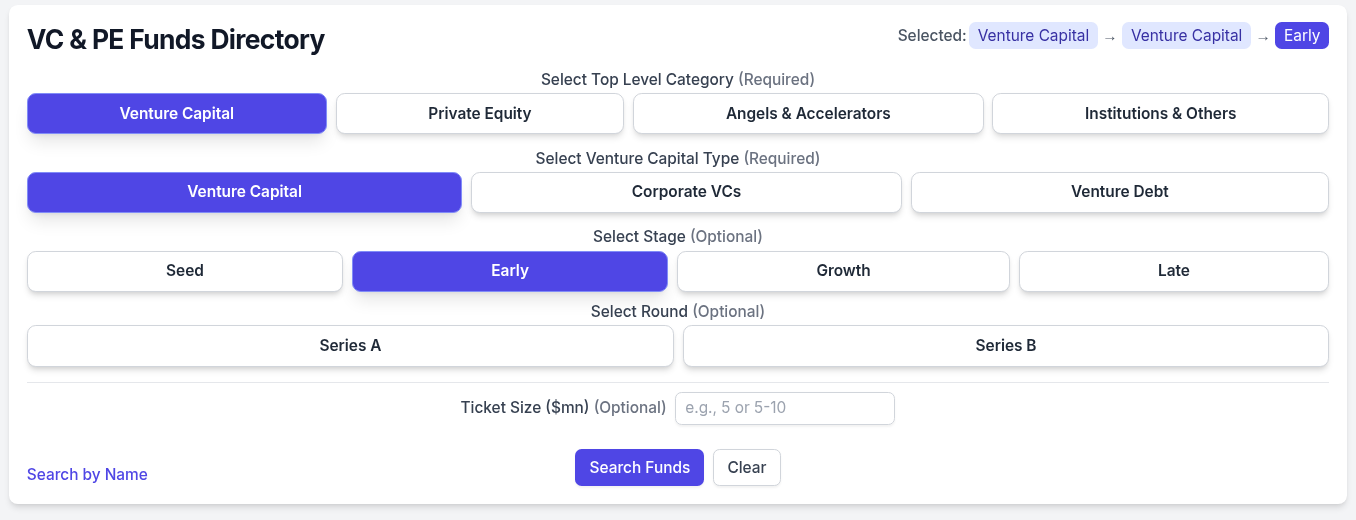

Seed, Series A & B - these are like the core of the VC spectrum, and given how companies raising these rounds are still trying to firm up their offerings and markets and such and pivoting around, it just made sense to have Series A & B as the Early category.

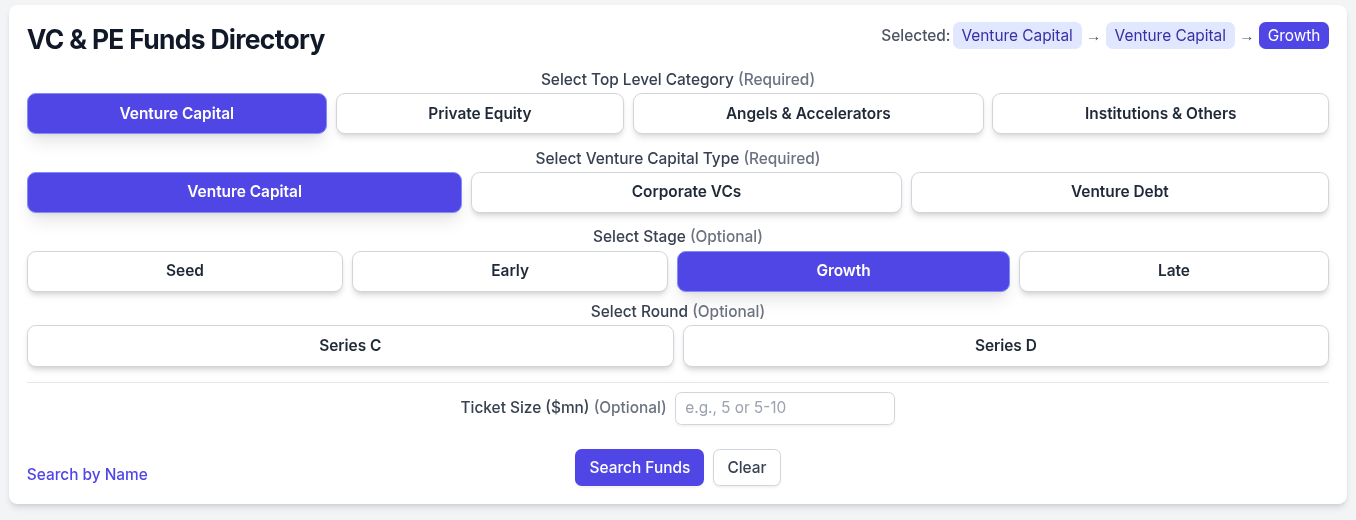

Series C & D are close to the traditional growth equity from the private equity stable and so what better way to classify them than as Growth. Also, Series C & D are firmly in the growth stages for companies, where they have distilled down their offerings and playbooks to what works and are looking to scale those.

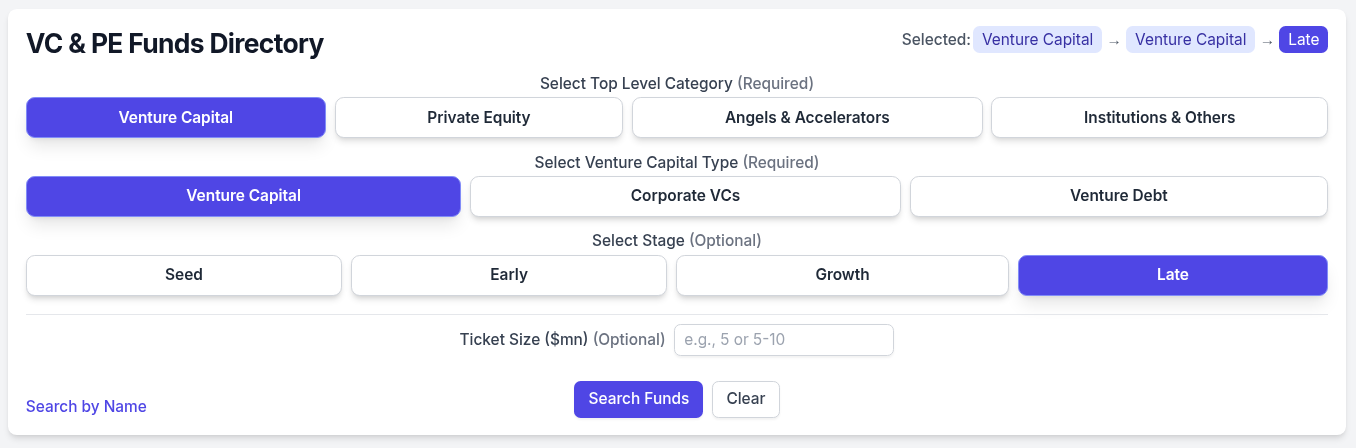

Once you are past Series C & D, it is getting late for the early VCs and they are thinking of exits. At the same time, companies hitting Series Es and beyond have probably managed to successfully scale their core offerings and are now looking to expand beyond into maybe newer offerings or markets or customer segments and so on - while these are all markers of growth rounds, but given the intent to prevent the alphabet creep, all of these rounds got grouped under Late - be it Series E or Z.

And there you have a simple and working scale of the VC strategy spectrum. The next time you are sinking in the alphanumeric swamp of early stage rounds, just remember this scale and get back to firm land.